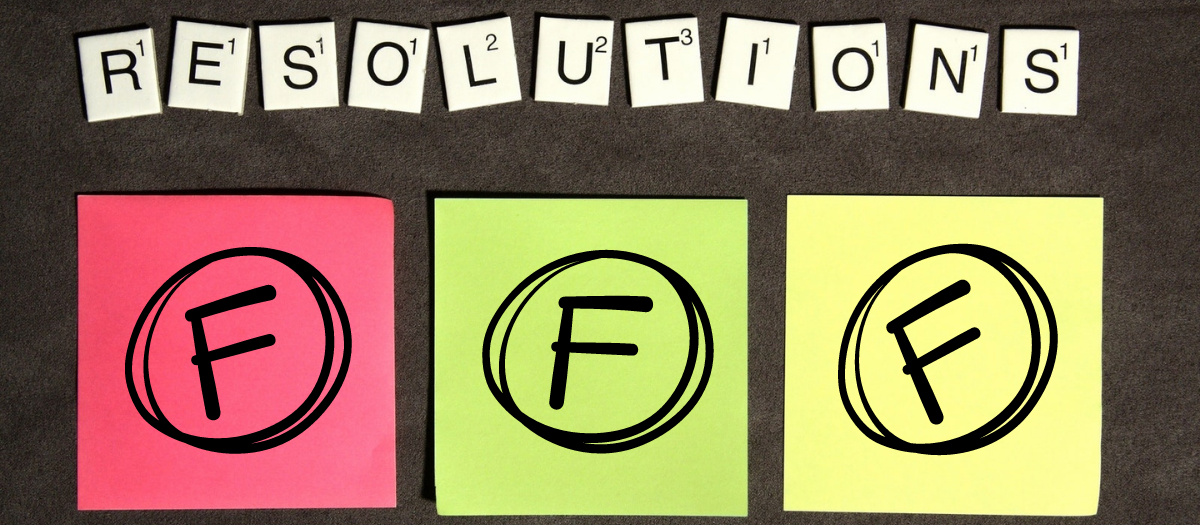

3 Reasons Your Resolutions Are Already Failing

Have you failed your resolution for 2022 yet? Don’t panic! If you’re like most people, your answer is probably “yes.” About 84% of people aren’t able to follow through on their resolutions, but that doesn’t mean you should throw in the towel!

It is absolutely possible to stick to your resolutions—you just need to recognize the common pitfalls of failing resolutions and plan to overcome them. Luckily for you, we’ve gathered three reasons many resolutions fail and some ways you can get back on track.

Setting Unrealistic Goals

Let’s be honest. Were your goals of exercising seven days a week or getting eight hours of sleep every night realistic for your lifestyle? Probably not, and that’s okay to admit. We like people who dream big! But you’ll likely find more success in setting small, measured goals for yourself that you can work up to over time.

Instead of jumping to seven days of hardcore exercise, start with just three days a week. Or start even smaller by setting aside just 15 minutes a day for some sort of movement. As you build this new habit, you can increase your intensity over time. There’s no need to overwhelm your mind and body. It’s okay to work at your goals one step at a time.

This logic can apply to many other resolutions. For example: learning a new skill, finding a new hobby, or saving for a goal. If you have a financial goal like paying off debt or saving for a large expense, our team can help you set achievable goals that work for your unique financial situation.

Avoiding the Hard Truth

Failure isn’t a pretty sight. Nobody likes to face their shortcomings, especially when it comes to achieving a goal that is close to their hearts. When people fall behind on their resolutions, they often like to ignore the issue and avoid checking their progress, whether it be on the scale, in a savings account, or in the pile of unused crafting supplies they bought a month ago.

While avoiding the hard truth might give you relief in the moment, it will only cause you to fall further and further away from your goals. Sit down and have an honesty session with yourself: where have you fallen off track? Why have you fallen off track? How can you get back on track in a realistic way?

If you’ve found that you’re off-track with your financial goals and are scared to look at your account balance, don’t be afraid to come talk to us. We are dedicated to providing judgement-free financial advice. We know that everybody has a story to their situation, and we want to help as many people become financially healthy as possible! We’re always happy to be your accountability partner.

Building Big Barriers

You know the expression “making a mountain out of a molehill?” That applies to your resolutions, too. We know barriers can get in the way of your resolutions but ask yourself if you are making those barriers bigger than they need to be.

For example, we often say that there just isn’t enough time in the day to do everything we want; however, that might not be as true as it seems. Sure, you might not have an hour to dedicate to money management or exercise every day, but you probably have just 15 minutes. Even that short amount of time is better than nothing. Plus, you’ll probably feel a boost of accomplishment from that time of productivity. This boost can help you grow more comfortable with the idea of setting aside that time each day.

Ask yourself if your barriers are actually as big as they seem, and if they are big, is there an alternate route you can take to accomplish your goal. Need a second set of eyes? We can help examine your financial situation and create a plan to better overcome your barriers.

When it comes down to it…

Sometimes, resolutions just don’t stick. But with the right set of expectations, plans, and accountability partners, you can absolutely accomplish your goals this year. Be honest with yourself about your fallbacks, celebrate your triumphs, and turn to others when you need help—especially Caro. We’re ready to help you achieve all of your financial resolutions and support you along every step of your life journey.