NEWS

December 4, 2025

Prepare Your Home for 2026: Smart Ways to Plan Your Updates Now As the year wraps up, many homeowners start thinking ahead to the improvements they’d […]

September 16, 2025

What Is Disability Insurance, and Do I Need It? Someone at work mentioned disability insurance, and now you’re wondering: “Do I actually need that?” Maybe. Because […]

September 16, 2025

How Much Should I Have in My Emergency Fund? Let’s be real: Emergencies don’t RSVP. They show up unannounced — usually at the worst possible time […]

September 16, 2025

How Do I Plan for Natural Disasters Financially? Let’s face it: When a natural disaster strikes — whether it’s a wildfire, hurricane, flood, or earthquake — […]

September 5, 2025

How Can I Save on Health Care Costs? Let’s face it: Health care in the U.S. is complicated, expensive, and often just plain overwhelming. And yet, […]

July 30, 2025

What Should My Child Know About Budgeting Before College? Q: I’m sending my kid off to college soon, and I just want to make sure they […]

July 30, 2025

What Are the Best Tools for Teaching Kids About Money? Q: I really want to help my kids learn how to be good with money, but […]

July 30, 2025

How Much Allowance Should I Give My Kids? Q: I’m trying to figure out what’s normal when it comes to giving kids allowance. How much is […]

July 30, 2025

How Do I Handle Financial Boundaries with Family? Q: My family sometimes asks for money or help with things I didn’t plan for, and it’s starting […]

July 24, 2025

Fraud Tactics Are Evolving—Here’s How to Stay Ahead Fraudsters are getting smarter, but so are you. At Caro, we believe knowledge is power—especially when it comes to […]

July 10, 2025

Your College Freshman Launch Plan Sending your teen off to college is exciting — and emotional. Between the tears and Target runs, there’s a lot to […]

July 10, 2025

Raising Kids Is Priceless — But It Isn’t Cheap Raising children is one of life’s greatest joys — and one of its biggest costs. Today, it […]

July 10, 2025

Moving Soon? Avoid These Common (and Costly) Mistakes Planning a move soon? You’re in good company. According to Zillow, June is the most popular month to […]

July 10, 2025

Stress-Free Summer Shopping in 2025 Welcome to summer 2025, where the sun’s out, prices are up, and we’re all just trying to keep our bank accounts […]

July 10, 2025

5 Ways Kasasa® Helps You Save Without Thinking Let’s be real… everything is more expensive in 2025. Groceries, gas, even streaming services. That’s why finding small […]

July 3, 2025

Should I Pay for My Child’s Education or Encourage Loans? Q: When it comes to college, should I be trying to pay for it all myself […]

July 3, 2025

How Do I Plan for Big Expenses Like a Wedding or New Baby? Q: I’ve got a couple of major life events coming up — definitely […]

July 3, 2025

How Do I Balance College Savings with Retirement Planning? Q: I’m trying to save for both my kid’s college and my own retirement, and I honestly […]

July 3, 2025

How Can I Budget for a Family Vacation? Q: We really want to take the whole family on a big vacation in the next year or […]

June 11, 2025

What Should I Know About Property Taxes? Q: I know that when you buy a home, you have to pay property taxes, but I don’t really […]

June 11, 2025

What Is Private Mortgage Insurance (PMI), and How Can I Avoid It? Q: I’ve been seeing the term “PMI” pop up while researching mortgages, but I’m […]

June 11, 2025

What Are Closing Costs, and How Much Should I Expect? Q: I keep hearing about “closing costs” when buying a house, but I’m not totally sure […]

June 11, 2025

How Much House Can I Afford? Q: I’m finally ready to buy a house after saving for years to get enough together for a down payment. […]

April 24, 2025

How Much Should I Save vs. Invest? Question: I’m trying to be smart with my money, but I’m not sure how much I should be saving […]

April 24, 2025

What Are the Tax Implications of Investing? Question: I’m starting to invest for the first time, and I keep hearing people talk about taxes on investing… […]

April 24, 2025

Investing for Beginners Question: I know I need to be investing for my future, but it sounds really complicated and risky! How does it actually work, […]

April 24, 2025

What Are The Best Strategies for Retirement Investing? Question: I know I should be saving for retirement, but with so many options out there — 401(k)s, […]

April 10, 2025

Helping Your Teen Build Financial Confidence for Life Raising a financially capable teen doesn’t require a finance degree – it starts with everyday conversations and real-life practice. […]

April 10, 2025

HELOC vs. Home Equity Loan: What’s the Best Fit for You? If you’ve built up equity in your home, you may be considering how to put […]

March 31, 2025

What Tax Benefits Are Available for College Savings? Question: I’m a new mom and I really want to help set my child up for success when […]

March 31, 2025

What Retirement Accounts Offer the Best Tax Advantages? Question: I recently got my first job, and began contributing towards retirement. I am very proud of myself, […]

March 31, 2025

How Can I Reduce My Taxable Income? Question: I always hear about tax deductions and ways to reduce your taxable income, but every year when I […]

March 31, 2025

How Do I Claim the Most Common Tax Deductions? Question: I just worked my first job in 2024, and will pay taxes for the first time […]

March 3, 2025

What Steps Should I Take to Simplify My Budget? Question: What steps should I take to simplify my budget? I’ve never been very “money-minded,” and because […]

March 3, 2025

What Should I Do If I Think I’ve Been Scammed? Question: I’m terrified that I may have been scammed. I accidentally gave my personal information to […]

March 3, 2025

What Documents Are Essential for Estate Planning? Question: I just had my first baby, and I know I need a will to make sure she’s taken […]

March 3, 2025

How Do I Build an Emergency Fund While Paying Off Debt? Question: I know that having an emergency fund is important, and I’ve been trying to […]

February 24, 2025

Let’s be real. Your bank is laughing all the way to, well… itself. Why pay monthly fees or settle for “free” checking that earns you absolutely […]

February 24, 2025

It’s never too early – or too late – to start thinking about a college savings plan. Whether your child is still in diapers or already picking out […]

January 30, 2025

Question: My wife and I struggle to talk about money without fighting. And because we know those conversations are likely to end in a fight, we […]

January 30, 2025

Question: I just got married and I’ve heard tons of mixed opinions on combining finances or keeping them separate… Is there a general rule of thumb […]

January 30, 2025

Question: I am struggling with financial infidelity in my relationship. My partner and I have both told “little white lies” about our spending over the years, […]

January 30, 2025

Question: My husband and I got married later in life and we never combined our finances. I trust him to manage his money, he trusts me […]

January 27, 2025

Ah, February. The month of love, overpriced chocolates, and the realization that winter isn’t leaving anytime soon. By now, your car has either proven itself a […]

January 27, 2025

Let’s be real. Traditional savings advice was clearly written for people who have a steady, predictable income and way too much self-control. “Save 20% of every […]

January 8, 2025

The New Year is the perfect time to hit refresh on your financial strategy – especially if holiday spending left you with high-interest credit card debt. A balance […]

January 8, 2025

New Year’s resolutions are back, so why not skip the cliché promises about gym memberships or carb-free diets and focus on something that sticks? This year, […]

January 8, 2025

Starting your credit journey might feel like trying to crack a secret code, but don’t worry – you’re in the right place. Let’s demystify the process, […]

January 8, 2025

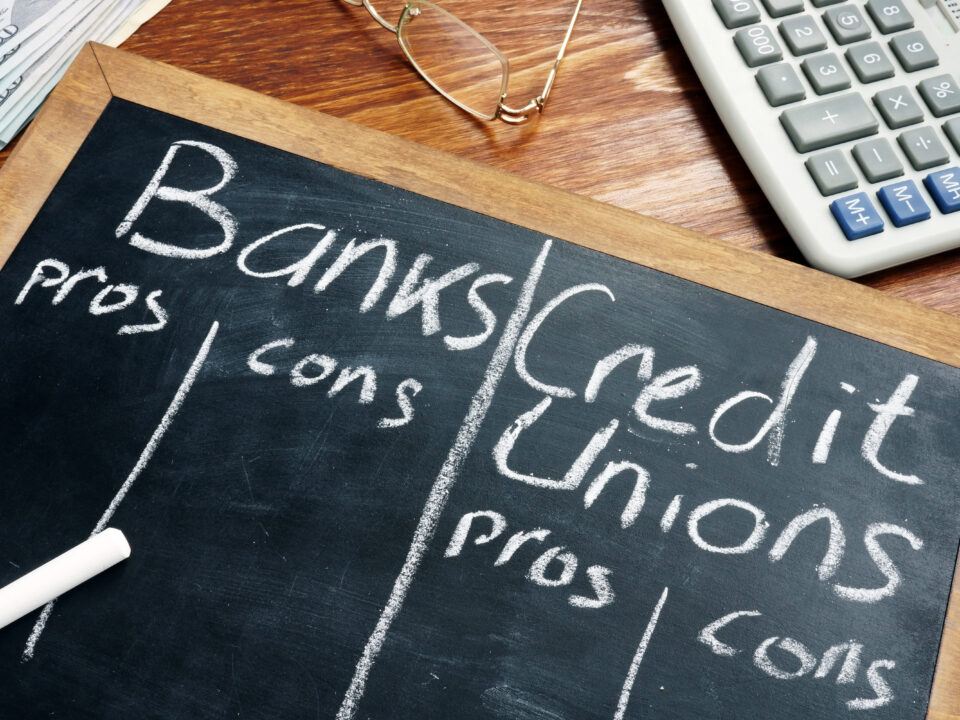

When deciding where to manage your money, the difference between a credit union and a bank is key to finding the right fit. At Caro , […]

January 8, 2025

Paper checks continue to be a trusted and familiar tool for many Caro members. Whether you prefer their tangible nature or value their straightforward reliability, checks […]